It’s not uncommon to feel overwhelmed when navigating the complex world of insurance claims after an accident in Los Angeles. With a multitude of policies and procedures to consider, understanding your rights and responsibilities can significantly affect the outcome of your claim. Whether you’re dealing with medical expenses, property damage, or lost wages, knowing how to effectively communicate with your insurance provider is necessary. This guide will equip you with the information you need to confidently manage your claims process and ensure you get the compensation you deserve.

Understanding Your Insurance Coverage

As you navigate the aftermath of an accident in Los Angeles, grasping your insurance coverage is imperative. Having a clear understanding of your policy will empower you to manage the claims process effectively. Dive into the specifics of your coverage to ensure you’re prepared for whatever comes next.

Types of Auto Insurance in California

Among the various options available, it’s vital to know the types of auto insurance you can choose from in California:

| Liability Insurance | Covers damages to others in an accident you caused. |

| Collision Insurance | Pays for damage to your vehicle after an accident. |

| Comprehensive Coverage | Protects against theft, vandalism, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Offers safety in case you’re hit by an uninsured driver. |

| Personal Injury Protection (PIP) | Covers your medical expenses, regardless of fault. |

This will set a foundation for how to approach any accident-related issues in the future.

Minimum Coverage Requirements in Los Angeles

Behind the scenes of insurance policies are the minimum coverage requirements mandated by California law. These minimums establish a safety net, ensuring that all drivers have basic protections in place. You need to be aware of these regulations to secure yourself adequately.

Consequently, California law requires you to carry a minimum of $15,000 in liability coverage for injuries per person, $30,000 per accident, and $5,000 for property damage. These amounts will protect you against financial losses in the event of an accident, but they may not be sufficient if you cause significant damage or injuries. Evaluate your risks and consider higher limits for enhanced security and peace of mind.

Immediate Steps After an Accident

Some of the most important steps to take after an accident involve ensuring your safety and understanding your rights. First, move to a safe location if possible and call for emergency services. This will help address any injuries and manage the scene effectively. Next, take a moment to gather your thoughts and avoid discussing fault; any admission could complicate your claim later on.

Documenting the Scene

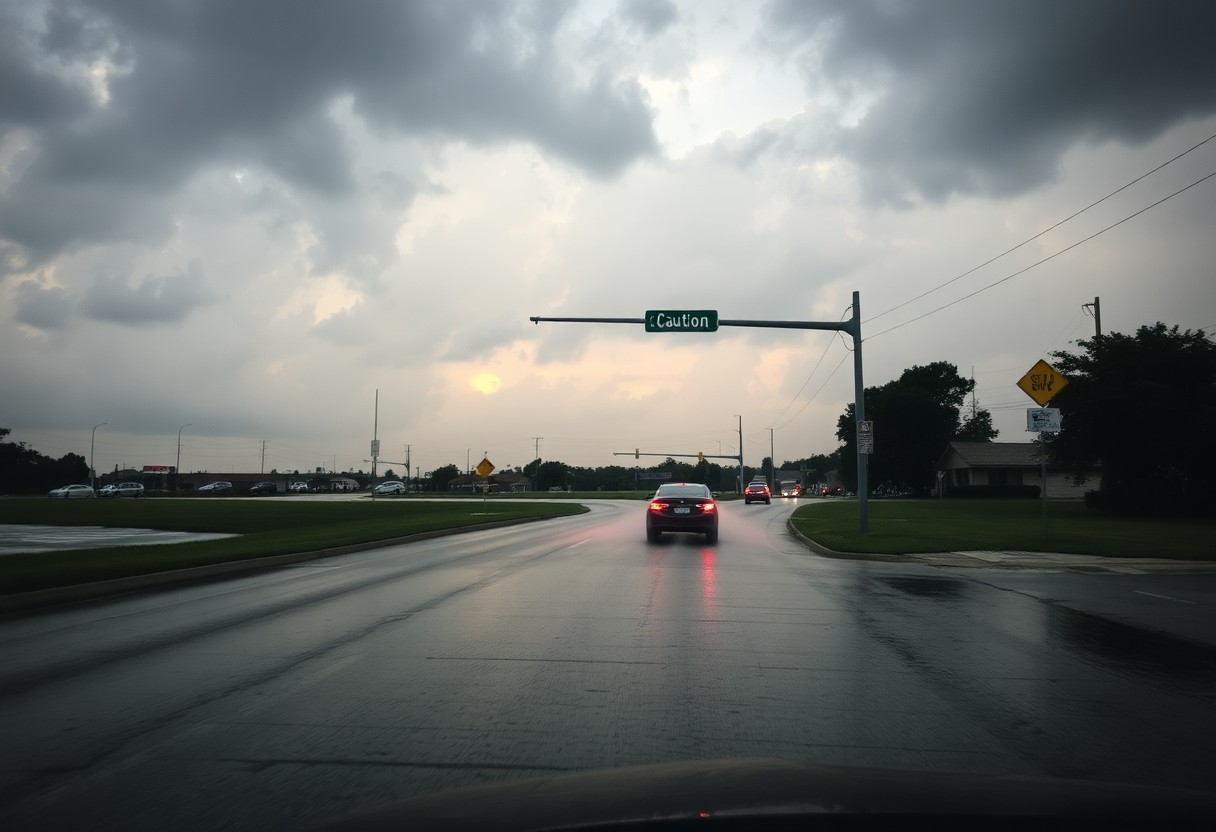

On the scene of the accident, it’s vital to gather as much information as possible. Start by taking clear photographs of both vehicles, any damage, and the surrounding area, as well as street signs and signals. These images can serve as necessary evidence in your claim.

Gathering Essential Information

Across the accident scene, gathering details from witnesses and the involved parties is important. Be sure to record names, contact numbers, and insurance information for other drivers. This data will be beneficial when filing your insurance claim and may provide additional support if disputes arise.

Another significant aspect of gathering information is noting the weather conditions, time of day, and any traffic signals that were present. You should also inquire if anyone witnessed the incident; their accounts might prove invaluable. Keeping this information handy, including your own insurance policy details, creates a solid basis for your claim. The more comprehensive your documentation, the stronger your position will be during the claims process.

Filing Your Insurance Claim

It is necessary to file your insurance claim promptly after an accident. This process will initiate communication with your insurance provider, allowing you to begin the journey towards obtaining compensation for your damages. Be prepared to provide detailed information about the incident, including dates, times, and descriptions of events, to streamline the process and avoid delays.

Initial Contact with Insurance Companies

Behind every successful insurance claim is an effective initial contact with the insurance company. When you reach out, be prepared with relevant information about the accident, including other parties involved and witnesses. Clear communication is key; don’t hesitate to ask questions about the process and expected timelines.

Required Documentation and Forms

Your insurance claim will require specific documentation and forms to support your case. You will need to submit a police report, photographs of the accident scene, medical records, and any other relevant evidence. Each insurance company may have its own unique requirements, so be sure to inquire about their specific needs.

With your claim, submission of accurate and complete documentation can significantly affect the outcome of your case. Essential documents include a police report, which captures the details of the accident, and medical records that outline your injuries. Photographic evidence can visually support your narrative. Additionally, gather any receipts related to vehicle repairs and medical expenses as they will support your claim for compensation. By assembling this documentation thoroughly, you bolster your case and facilitate a smoother review process with your insurance provider.

Navigating the Claims Process

Once again, the insurance claims process may seem overwhelming, but breaking it down into manageable steps can help. Start by gathering all necessary documentation, including accident reports, medical records, and communication logs. This organized approach will enable you to efficiently present your case to your insurance company, increasing the likelihood of a favorable outcome.

Timeline and Deadlines

At the onset of your claim, it’s necessary to be aware of the timelines and deadlines that govern the process. Different insurers may have varying reporting requirements, and not adhering to these can jeopardize your claim. You should be proactive, maintaining a calendar of critical dates to ensure you meet all necessary obligations, from filing initial claims to providing additional information.

Communication with Claims Adjusters

The effectiveness of your claim heavily relies on your communication with claims adjusters.

Claims adjusters are the gatekeepers of the insurance process, and open, honest dialogue with them can significantly impact the outcome of your claim. Being clear and concise in your explanations will foster a better understanding of your case. Additionally, keeping a written record of your conversations can serve as a reference to prevent miscommunication. Always remain professional and courteous; this will encourage adjusters to work more diligently on your behalf. However, be cautious—avoid admitting fault or providing statements that could undermine your claim, as this can be detrimental to your case.

Common Challenges and Pitfalls

All navigating the insurance claims process after an accident in LA can feel like a daunting task. You may encounter various hurdles, such as confusion over policy details, miscommunication with your insurer, or even unexpected delays. Being aware of these common challenges and pitfalls can help you better prepare and advocate for your rights, ensuring that you receive the compensation you deserve for your losses and expenses.

Dealing with Claim Denials

By having your claim denied, it can be frustrating and overwhelming. Insurers may reject claims for various reasons, including policy exclusions or insufficient documentation. When faced with a denial, it’s crucial to understand the specific reasons behind it and gather evidence to support your case for appeal. You have the right to question the decision and seek a fair resolution.

Understanding Settlement Offers

About settlement offers, they can often seem appealing at first glance, but you should approach them with caution. Insurers may propose quick settlements to close the case, which may not fully reflect the total costs of your injuries or damages. Always evaluate the offer carefully, considering all current and future expenses related to your accident.

At this stage, it’s crucial to analyze the details of the settlement offer thoroughly. Consider both immediate and long-term medical expenses, potential loss of earnings, and the impact on your quality of life. Accepting too low of an amount can jeopardize your financial security. It may be beneficial to consult with a legal expert who can help you determine a fair value for your claim and negotiate on your behalf, ensuring that you don’t settle for less than you deserve.

Legal Considerations

Not understanding the legal framework surrounding your accident can lead to complications in your insurance claims process. It’s vital to grasp your rights and responsibilities in the aftermath of an accident to navigate the maze of insurance claims effectively. Familiarizing yourself with the laws applicable in Los Angeles not only helps in making informed decisions but also safeguards your interests throughout the claims process.

When to Hire an Attorney

Across the spectrum of accident claims, knowing when to hire an attorney is vital. If you find your case complicated by injuries, involved parties, or insurance disputes, seeking legal counsel can provide clarity and support. An attorney can champion your cause, negotiate on your behalf, and alleviate the burden of dealing with insurance companies directly.

Statute of Limitations in California

Limitations on how long you have to file a claim can impact your recovery. In California, you generally have two years from the date of your accident to initiate a personal injury claim. If you miss this deadline, you may lose the chance to pursue compensation for your damages.

But understanding the statute of limitations is vital to ensuring your rights are protected. Filing your claim within a two-year window is critical; failing to do so could result in a situation where you are barred from recovery. As circumstances can affect this timeline, such as accident specifics or involved parties, it’s wise to consult with a legal professional early in the process to avoid pitfalls and secure your legal rights.

Conclusion

From above, navigating the complexities of insurance claims after an LA accident can be daunting, but understanding the process enables you to advocate for your rights effectively. By documenting every detail and communicating clearly with your insurance provider, you can streamline your claims experience. Seeking expert advice when necessary will empower you to make informed decisions. Ultimately, being proactive and organized will help you obtain the compensation you deserve, allowing you to move forward with confidence.