Just when you think your trucking insurance will protect you, you may find that many companies prioritize their profits over your well-being. In Alabama, these insurers often leave you vulnerable during claims, focusing more on minimizing payouts than on truly supporting you. Understanding the tactics employed by these companies can help you navigate potential pitfalls, ensuring you get the coverage you deserve. Your best interests may not align with theirs, which is why being informed about your policy and your rights is necessary to safeguarding your trucking business.

Understanding Trucking Insurance Basics

Before submerging into the complexities of trucking insurance, it’s necessary to grasp the fundamentals. Insurance acts as a financial safety net, protecting you against unforeseen expenses due to accidents, damages, or liabilities. Knowing how it functions will empower you to make better decisions regarding your trucking business and ensure adequate coverage in critical situations.

Types of Trucking Insurance

- Liability Insurance

- Cargo Insurance

- Physical Damage Insurance

- Bobtail Insurance

- Motor Truck Cargo Insurance

Perceiving these types of insurance will help you assess what fits your needs best and avoid unnecessary gaps in coverage.

| Type of Insurance | Purpose |

| Liability Insurance | Covers damages to others |

| Cargo Insurance | Protects cargo from loss or damage |

| Physical Damage Insurance | Protects your vehicle |

| Bobtail Insurance | Covers you when not under dispatch |

| Motor Truck Cargo Insurance | Safeguards freight while in transit |

Key Terminology Explained

Terminology in trucking insurance can often be overwhelming, but understanding it is vital for making informed decisions. Familiarize yourself with key terms that will help you navigate your policy documents and discussions with agents.

Hence, grasping terms like deductible, which refers to the amount you pay out-of-pocket before insurance kicks in, and premium, the amount you pay for coverage, is necessary for effective budgeting. Understand also that coverage limits determine the maximum amount your insurer will pay for a claim and that exclusions specify what is not covered, which can significantly impact your safety and financial stability. Investing time in learning this terminology not only protects your assets but also enhances your overall business acumen.

The Role of Insurance Companies

If you are navigating the trucking industry in Alabama, understanding the role of insurance companies is vital. They are tasked with assessing risk and providing coverage; however, their primary goal is often to protect their own bottom line. This means they may prioritize their profits over your needs, leaving you vulnerable in the event of an accident or claim.

How Insurance Companies Operate

Insurance companies operate by collecting premiums from policyholders to create a revenue pool. When an accident occurs, they assess the claim based on various factors, including the policyholder’s history and the incident’s details. Unfortunately, they may employ tactics to minimize payouts, ultimately impacting your financial protection.

Profit Motives and Their Impact

Beside the significant role they play in your coverage, insurance companies are heavily driven by profit motives. This focus can lead to practices that jeopardize your security as a trucker, forcing you to endure longer claim processes or inadequate payouts when accidents happen.

Insurance companies rely on maximizing revenue while minimizing payouts. This often translates into rigorous claim evaluations and potentially unfavorable outcomes for you, the policyholder. You may find that when you need support the most, these companies are more concerned with preserving their profits than acting in your best interest. In many cases, your safety and financial well-being might take a backseat to their profit goals, leaving you at a disadvantage when seeking assistance after an incident.

Common Pitfalls for Trucking Companies

One of the most significant obstacles you may face as a trucking company is navigating the intricacies of insurance coverage. Many businesses underestimate the complexities involved, leading to undesirable outcomes that can jeopardize your operation and financial well-being.

Underinsurance Issues

Trucking companies often find themselves grappling with underinsurance, which can leave you vulnerable in the event of an accident or incident. Insufficient coverage may not fully protect your assets or liabilities, leading to severe financial repercussions that could threaten your business’s longevity.

Claims Denials and Delays

Common challenges faced by trucking companies include claims denials and delays, which can severely affect your cash flow and operations. When you submit a claim, the insurance company may scrutinize every detail, and if they find any reason—often tenuous—they might deny your claim altogether.

Considering the difficulties surrounding claims, you should be aware that a denied claim can drain your resources and disrupt your operations. Insurance companies may also employ tactics like lengthy investigations or excessive documentation requests to delay payment. This can leave you feeling overwhelmed and at a loss during critical times, highlighting the importance of understanding your policy and maintaining thorough records.

Regulatory Environment in Alabama

Not every trucking insurance company in Alabama understands the stringent regulatory environment that you must navigate. State regulations can significantly impact your insurance coverage, making it crucial to stay informed about the latest requirements and compliance expectations. Alongside federal mandates, local rules add layers of complexity, often leaving you vulnerable and under-insured without proper guidance.

Insurance Requirements for Trucking

Among the various mandates, Alabama requires truckers to carry a minimum amount of liability insurance, as well as proof of financial responsibility. This obligation is designed to protect both you and other road users, but unfortunately, it can also create gaps in coverage if you’re not adequately informed about the specific requirements.

State-Specific Challenges

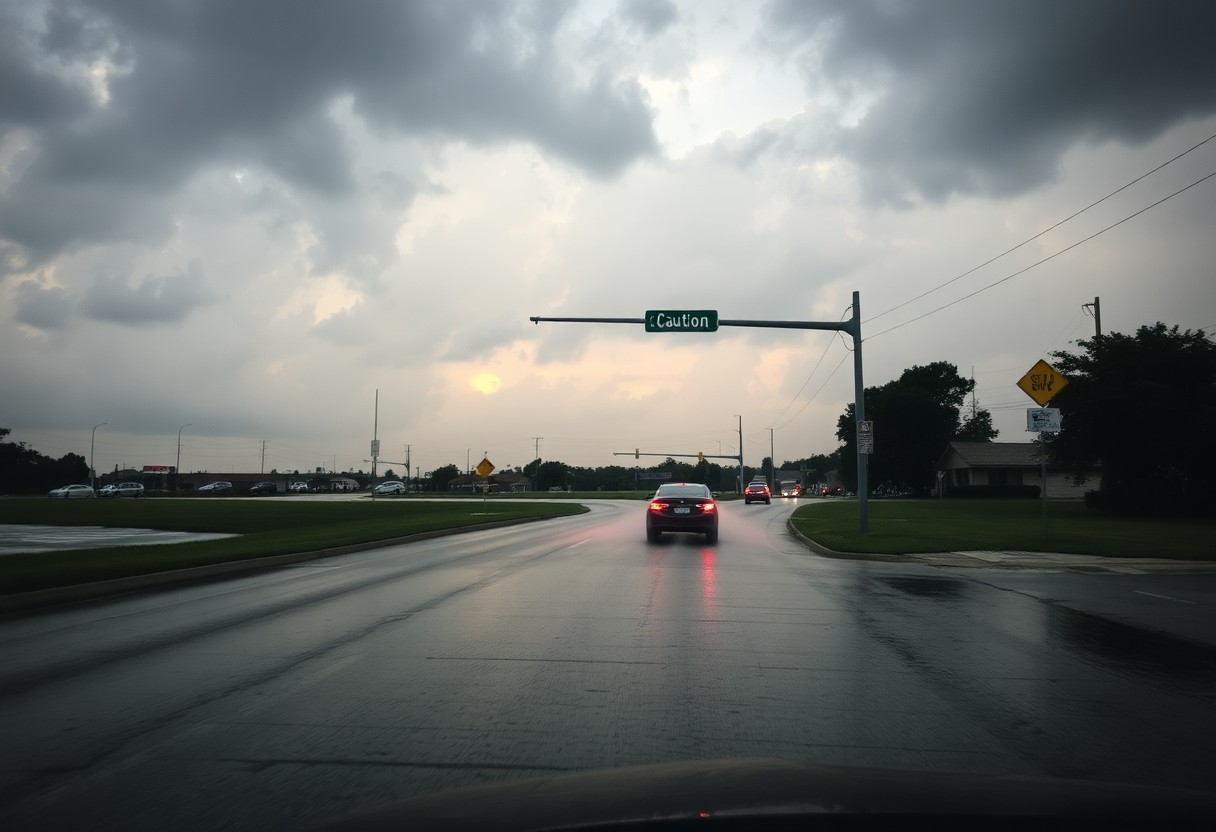

Behind the veil of insurance regulations, numerous challenges exist within Alabama’s unique trucking landscape. Different regions may impose varying rules, and the inconsistency can lead to confusion regarding compliance and coverage. Factors such as local road conditions, traffic patterns, and enforcement levels all influence your day-to-day operations and insurance needs.

StateSpecific legislation often puts you at a disadvantage. Issues with varying permit requirements and zone regulations can complicate your transport routes. Additionally, to maintain your authority, you must navigate through frequent inspections and potential penalties for non-compliance, which can further elevate your insurance costs. Being proactive in understanding these state-specific challenges is critical to ensuring you are not left exposed and can help you mitigate risks while pursuing your business goals.

Strategies for Navigating the Insurance Landscape

Despite the complexities of the trucking insurance industry, you can successfully navigate the landscape by arming yourself with knowledge and strategic planning. Understanding policy options, comparing providers, and utilizing resources like professional networks can help you make informed decisions that protect your interests and bottom line.

Choosing the Right Insurance Provider

By taking the time to research and compare various insurance providers, you increase your chances of finding a company that genuinely meets your needs. Look for providers with a proven track record, strong customer service, and transparent policies to ensure you are not left in the lurch when you need support the most.

Advocating for Fair Treatment

Choosing to advocate for fair treatment is important in a landscape where insurance companies may prioritize profit over your well-being. Seek clarity on your policy terms and hold your insurer accountable to ensure that you receive the coverage and support you deserve.

Hence, it is vital to be proactive in your quest for fair treatment from your insurance provider. Document every interaction you have with them and keep records of all communications. If you feel your concerns are not being addressed, consider reaching out to a legal professional or an experienced insurance broker who can assist you in negotiating better terms or representing your case effectively. Taking these steps will empower you to stand your ground and ultimately achieve a more equitable resolution.

Real-Life Case Studies

Once again, it’s crucial to analyze the behavior of trucking insurance companies in Alabama through real-life examples. These case studies reveal how these companies operate and their impacts on your business:

- Case Study 1: A small trucking company faced a $500,000 claim due to a faulty vehicle but received only $150,000 from their insurance.

- Case Study 2: An independent truck driver sued their insurer for denying a claim, only to find that they were underinsured by 40%.

- Case Study 3: A fleet of 10 trucks had an accident resulting in $1 million in damages yet the insurer disputed the coverage based on minor policy variations.

- Case Study 4: A trucking startup was forced to close after their insurer delayed payments for over six months, leading to financial ruin.

Success Stories

RealLife examples illustrate how some companies navigated successfully through the insurance landscape by leveraging legal advice and thorough policy understanding to secure fair settlements, allowing them to continue operating without significant setbacks.

Cautionary Tales

Among the unfortunate tales, many truck drivers and companies have found themselves in dire situations due to inadequate insurance coverage, often resulting in catastrophic losses.

In addition to the financial loss, truck drivers may face legal challenges that detract from operational focus. One negative outcome of inadequate insurance can lead to a total loss of a trucking business, as seen in cases where insurance companies denied claims based on technicalities. You must be vigilant when selecting your policy to avoid being underinsured, as this places your entire business at risk when unexpected incidents arise.

Summing up

Hence, it’s imperative for you to understand that trucking insurance companies in Alabama often prioritize their profits over your needs. They may use complicated policies and tactics that leave you feeling frustrated and under-compensated. By staying informed about your rights and the nuances of your coverage, you can better navigate the challenges posed by these companies and advocate effectively for your interests. Taking an active role will empower you to ensure that your business is adequately protected against potential losses.