Just having an accident can be overwhelming, especially when it involves a truck. You need to navigate the complex world of trucking insurance claims to ensure your rights are protected and you receive the compensation you deserve. This guide will walk you through the steps to take immediately after an incident, how to document everything effectively, and the best practices for filing a claim with your insurer in Decatur. With the right approach, you can turn a stressful situation into a manageable process.

Understanding Trucking Insurance Claims

For anyone involved in a trucking accident, navigating the trucking insurance claims process can be daunting. Having a solid understanding of your insurance policy and the claims process is vital to ensure timely and fair compensation for damages and injuries. Awareness of your rights and the specifics of your coverage will empower you to address claims more effectively.

Types of Trucking Insurance

For trucking companies, several types of insurance protect against various risks. Here are key options:

- Liability Insurance – covers damages you cause to others

- Cargo Insurance – protects your freight during transport

- Physical Damage Insurance – covers your truck against theft or damage

- Workers’ Compensation Insurance – provides for employee injuries

- Comprehensive Insurance – shields against non-collision incidents

The right mix of coverage helps you navigate risks effectively.

| Type of Insurance | Description |

| Liability Insurance | Covers claims made against you for injuries or damages to others. |

| Cargo Insurance | Insures the cargo being transported, protecting you from financial loss. |

| Physical Damage Insurance | Protects your truck from damages caused by accidents, theft, or vandalism. |

| Workers’ Compensation Insurance | Covers medical costs and lost wages for employees injured on the job. |

| Comprehensive Insurance | Lists risks beyond collisions, like natural disasters or vandalism. |

Common Reasons for Claims Denial

Insurance companies often deny claims for various reasons, which can be frustrating.

Understanding the common reasons for denial can help you prepare better. Claims may be denied due to incomplete documentation, failure to comply with policy requirements, pre-existing conditions, late filing, or non-covered incidents. It is vital to communicate regularly with your insurer and ensure that you submit all necessary paperwork accurately to minimize the risk of denial.

Steps to Take Immediately After an Accident

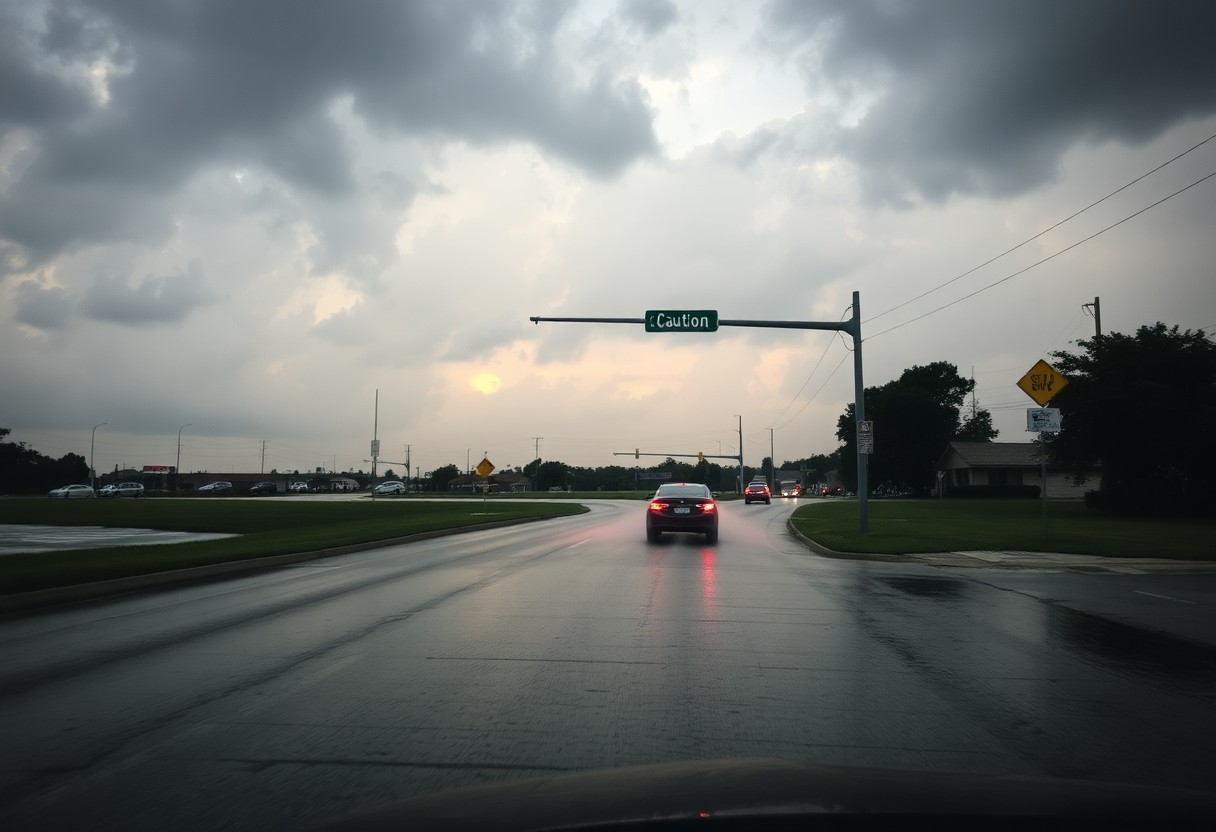

If you find yourself involved in a trucking accident in Decatur, it’s crucial to stay calm and follow specific steps. First, check for injuries and call emergency services if needed. Ensure the safety of yourself and others by moving to a safe location if possible. Collect information from other parties involved and witnesses, which will be invaluable for your claim.

Documenting the Scene

Assuming the situation is safe, take photos of the accident scene, including vehicle positions, damages, and any relevant road signs. Capturing these details will help provide visual evidence for your insurance claim and support your account of the events surrounding the accident.

Notifying Insurers Promptly

Clearly, you must inform your insurance company about the accident as soon as possible. This ensures your claim is initiated without delay and helps to address any potential liability issues that may arise.

Promptly notifying your insurer is vital for an efficient claims process. Providing them with detailed information, such as the police report, photos, and witness contact details, can significantly benefit your case. Delaying this notification may lead to complications or denial of your claim, ultimately jeopardizing your ability to receive the compensation you deserve. Stay proactive and maintain clear communication with your insurer to ensure a smoother resolution of your trucking insurance claim.

How to File a Trucking Insurance Claim

Some important steps will guide you through filing a trucking insurance claim following an accident in Decatur. Start by notifying your insurance company as soon as possible, ensuring you provide accurate information about the incident. Your insurer will supply you with the necessary forms and instructions, so it’s important to follow their guidelines closely to facilitate a smooth claims process.

Completing the Claims Process

Assuming you have reported the accident to your insurance provider, your next step is to complete the claims process by filling out all required forms accurately and promptly. Provide all relevant details and stay in contact with your insurer to resolve any outstanding inquiries they may have.

Providing Necessary Documentation

Assuming you’ve gathered the required information, you must compile all necessary documentation to support your claim. This includes police reports, photographs of the accident scene, medical records, and witness statements, among other pertinent information.

The documentation you provide plays a vital role in determining the outcome of your claim. Ensure you include clear photographs of vehicle damage and the scene, along with any medical documentation that reflects injuries sustained during the accident. Collect witness statements to bolster your case, and don’t forget to include the official police report if available. Incomplete or inadequate documentation can delay your claim or lead to rejections, so take your time to gather everything carefully.

Tips for a Successful Claim Experience

Your approach to a trucking insurance claim can significantly impact its outcome. To enhance your chances of success, consider the following tips:

- Document the accident thoroughly.

- Communicate clearly with your insurance adjuster.

- Ensure timely filing of your claim.

- Provide accurate information and evidence.

- Consult a legal expert if needed.

Perceiving these tips as crucial steps will guide you toward a smoother claims process.

Communicating Effectively with Insurers

If you want your claim to be processed smoothly, clear communication with your insurer is crucial. Be professional and concise in your discussions, providing all necessary details while addressing any questions they might have.

Keeping Detailed Records

Effectively documenting every aspect of your trucking accident is vital for a strong claim. This includes maintaining records of police reports, medical bills, and witness statements, along with any correspondence with your insurer.

Keeping accurate and organized records can make a significant difference in the claims process. Ensure you have all pertinent details such as photographs of the accident scene, contact information of witnesses, and official documentation regarding damages. These records not only support your claim but also showcase your commitment and preparedness in pursuing justice. By keeping track of medical expenses and vehicle repairs, you fortify your position and enhance your chances of receiving a fair settlement.

Factors Influencing Claim Approval

Many elements can impact the approval of your trucking insurance claim after an accident in Decatur. Key factors include:

- Proof of liability

- Extent of damages

- Injuries sustained

- Policy details

Knowing these factors will help you understand the claim process better and improve your chances of a favorable outcome.

Proof of Liability

An imperative part of securing your claim approval involves demonstrating proof of liability. This requires gathering evidence that clearly shows who was at fault in the accident. You may need to compile documents such as police reports, witness statements, and photographs from the scene to establish responsibility.

Extent of Damages and Injuries

Any claim’s outcome heavily relies on the extent of damages and injuries incurred during the accident. The total cost of vehicle repairs and medical expenses will directly affect your settlement amount.

Proof of the total damages and injuries is imperative in determining the compensation you receive. It’s advisable to request detailed invoices from healthcare providers and obtain estimates from repair shops. The more comprehensive your documentation is, the more effectively you’ll substantiate your claim. Be vigilant in documenting medical treatments, vehicle damages, and any lost wages resulting from the accident, as all these aspects contribute to a more robust case.

When to Consider Legal Help

Not every trucking insurance claim requires legal intervention, but if you’re facing significant losses or complexities, it may be time to consult an attorney. You should particularly seek legal help when liability is disputed, injuries are severe, or if the insurance company is uncooperative. Having a legal expert can streamline the process and ensure your rights are protected.

Situations Requiring an Attorney

An attorney can be indispensable in various situations, including when you sustain serious injuries or when there are disputes concerning fault. If the insurance company is delaying your claim or offering an unfair settlement, it’s wise to consult a legal professional who specializes in trucking accidents.

Finding the Right Legal Assistance

Finding an attorney who understands trucking insurance claims is necessary. Look for someone with experience in personal injury law and a strong track record of handling similar cases.

Consider interviewing multiple attorneys to find the right fit for your case. You’re looking for a professional who provides personalized attention, communicates clearly, and has a solid understanding of trucking regulations. Additionally, check client reviews and ask about their success rate in similar claims. Your choice of legal assistance can significantly impact the outcome of your case, so it’s important to take the time to find someone who aligns with your needs and can advocate effectively on your behalf.

Summing up

The process of handling a trucking insurance claim after an accident in Decatur can be overwhelming, but taking it step by step can make it manageable. You should start by gathering all necessary documentation, including the police report, photos, and witness statements. Communicate promptly with your insurance provider, ensuring all details are accurate. Consider seeking legal advice if negotiations become complicated. By staying organized and proactive, you can navigate the claims process effectively and secure the compensation you deserve.