You may not realize it, but digital tools are revolutionizing how accident claims are processed in the City of Angels. With innovations like artificial intelligence and mobile apps, your experience after an accident can now be much more efficient and transparent. These technologies not only streamline communication between you and insurers but also enhance the accuracy of claims, turning a traditionally complex process into a smoother journey. As you navigate the aftermath of an accident, understanding these tech trends can help you leverage the best solutions available.

The Digital Revolution in Los Angeles Claims Processing

The rapid adoption of technology in Los Angeles has transformed claims processing, making it more efficient and user-friendly. With innovative digital solutions, you can now navigate the complexities of accident claims with greater ease, leveraging tools that streamline the entire process from reporting to resolution.

Mobile Apps and Real-Time Accident Reporting

Against traditional methods, mobile apps have revolutionized how you report accidents and manage claims. These user-friendly platforms allow you to transmit real-time data directly to insurers, enabling quicker response times and eliminating lengthy paperwork.

AI-Powered Claim Assessment Systems

For those dealing with insurance claims, AI-powered systems are changing the landscape, providing faster and more accurate assessments. These technologies leverage advanced algorithms to analyze data, minimizing human error and reducing processing times significantly.

Plus, these AI systems enhance your experience by offering personalized insights based on analytics, transforming how you engage with your claim. With AI at the helm, you can expect reduced turnaround times and improved accuracy in decision-making, ensuring your claims are processed promptly. Not only do these systems eliminate the need for repetitive data entry, but they also boost your confidence in the accuracy of outcomes, making your claims journey much more satisfying.

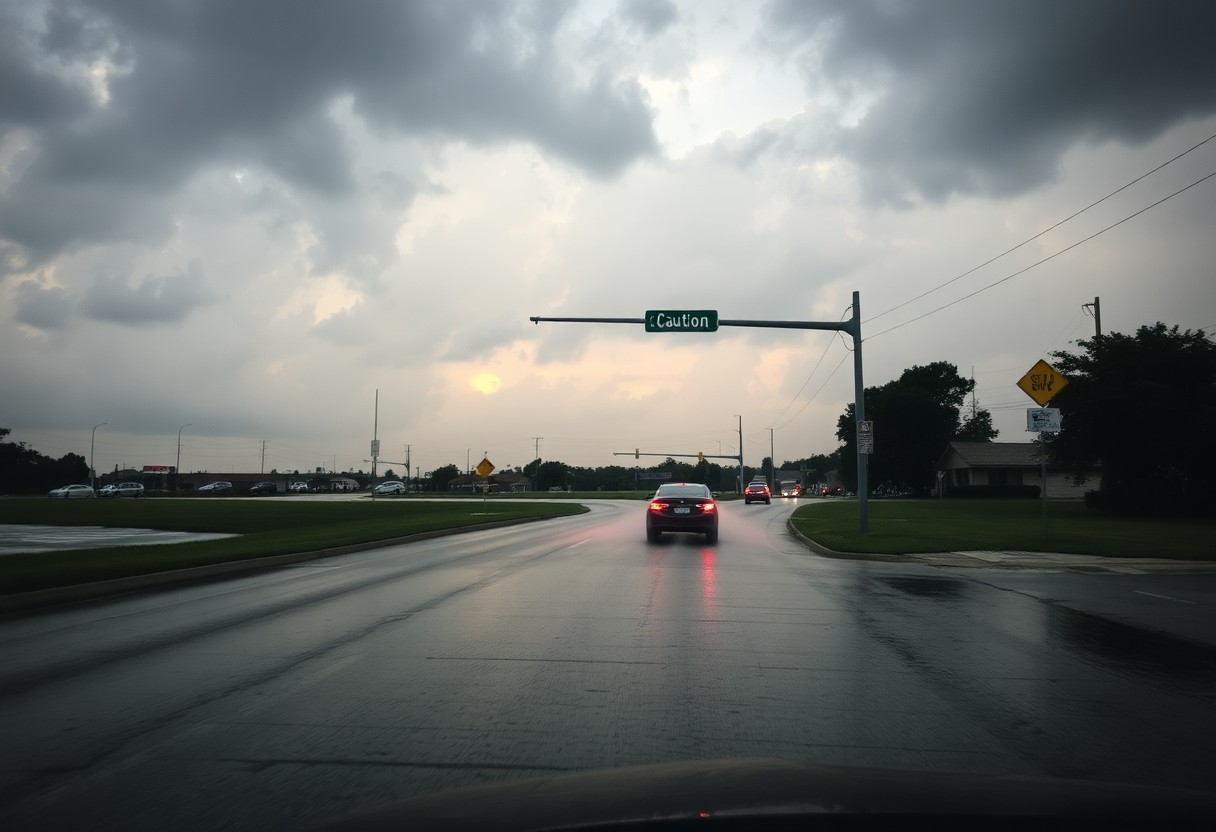

Emerging Technologies in Accident Documentation

It is imperative to embrace emerging technologies that enhance the accuracy and efficiency of accident documentation. These innovations not only streamline the claims process but also create a clearer picture of events, ultimately influencing the outcomes for all parties involved. As digital tools evolve, they unlock new possibilities for you and your vehicle insurance claims.

Drone Surveillance for Accident Scene Analysis

Documentation of accident scenes has been revolutionized by drone surveillance. These unmanned aerial vehicles capture high-resolution images and video footage, providing a comprehensive overview of the scene. With drone technology, you can gain instant access to critical visual data, which helps reconstruct events with precision and clarity, significantly aiding in the claims process.

IoT Devices and Vehicle Telematics

After an accident, IoT devices and vehicle telematics play a vital role in documenting information. These connected technologies gather real-time data on speed, braking patterns, and vehicle conditions, offering invaluable insights during the claims process.

Another advantage of IoT devices and vehicle telematics is their ability to provide real-time data that can be instrumental in demonstrating liability or defending against claims. By tracking and recording your vehicle’s speed, location, and behavior just before an accident, these technologies not only support your case but also enhance safety measures. Such detailed information can highlight driver errors or external factors affecting road conditions, ensuring that you have a robust foundation for your insurance claim.

Data Analytics and Risk Assessment

Clearly, the integration of data analytics in accident claims transforms the way you assess risks and validate claims. By sifting through vast amounts of data, insurers can identify patterns that mitigate risks and optimize claims processing. This technology not only streamlines operations but also empowers you with actionable insights that lead to improved decision-making and resource allocation in the bustling insurance landscape of Los Angeles.

Predictive Modeling for Claim Validation

Before venturing into the claims process, predictive modeling can help you determine the potential validity of a claim. By analyzing historical data, algorithms forecast the likelihood of fraud or false claims, streamlining investigations and allowing you to allocate resources more efficiently. This proactive approach can save you time and money while enhancing the overall integrity of the claims process.

Machine Learning in Fraud Detection

Machine learning is revolutionizing how you detect fraud in accident claims. This technology utilizes algorithms that continuously learn from new data patterns, enabling more accurate assessments.

Further leveraging machine learning can significantly improve your fraud detection strategies. With advanced algorithms analyzing behavioral patterns and historical data, you can identify potentially fraudulent claims with higher precision. This allows you to focus on legitimate claims and reduce unnecessary investigations. Moreover, the system becomes increasingly efficient over time, decreasing the risk of overlooking sophisticated fraud schemes. By utilizing machine learning, your organization can not only safeguard against losses but also enhance customer trust by processing valid claims more quickly and accurately.

Digital Communication Platforms

Not only do digital communication platforms streamline interactions between clients and legal teams in accident claims, but they also enhance transparency and efficiency. These platforms enable instant messaging, video calls, and real-time updates, ensuring that you remain informed every step of the way. With the ability to communicate quickly, you can share vital information and ask questions without the delays typically associated with traditional communication methods.

Client Portals and Virtual Assistance

An increasing number of law firms are adopting client portals and virtual assistance to provide you with seamless access to your case details. These digital solutions enable you to track the progress of your claim, upload documents, and receive personalized support at your convenience. With virtual assistants, you can have your inquiries addressed promptly, enhancing your overall experience during the claims process.

Secure Document Management Systems

Below, secure document management systems play a significant role in protecting your sensitive information throughout the accident claims process. These systems utilize advanced encryption and access controls, ensuring that only authorized personnel can view your documents. By employing such technology, you can trust that your private data remains safe and compliant with legal regulations.

Client confidentiality is paramount in legal matters, and secure document management systems create a reliable framework for maintaining this trust. By encrypting your documents and implementing stringent access controls, these systems prevent unauthorized access and ensure data integrity. You can easily share necessary documentation with your legal team while knowing that it is protected against breaches. Furthermore, the use of such systems promotes efficiency, as all important files are organized and easily retrievable, facilitating quicker decision-making in your case.

Blockchain Technology in Claims Management

Your understanding of claims management is about to transform with blockchain technology. This innovative approach increases efficiency, reduces fraud, and enhances transparency, all of which are imperative for streamlining accident claims. By leveraging decentralized ledgers, you can experience a trustless environment where all parties are held accountable, making your claims process smoother and faster.

Smart Contracts for Automated Settlements

Any time you file a claim, the potential for delays is a concern. Smart contracts built on blockchain facilitate automated settlements, ensuring that once predetermined conditions are met, payments are executed promptly. This automation not only accelerates the claims process but also mitigates human error and disputes, granting you peace of mind.

Transparent Transaction Records

After navigating the complexities of a claim, you deserve clarity regarding its status. Blockchain technology delivers transparent transaction records that track every step of the claims process. These immutable records ensure that you can see all interactions and money flows related to your claim, providing a clear and comprehensive view of any changes or updates.

Settlements through blockchain technology offer unprecedented visibility. Each transaction is recorded on a public ledger, allowing you to track your claim’s progress in real-time. This transparency prevents manipulation and ensures that you have access to your transaction history, giving you greater confidence in the claims process. By eliminating ambiguity, blockchain empowers you to remain informed and engaged, making your experience with accident claims less daunting.

Regulatory Technology Compliance

All organizations in the City of Angels are now leveraging regulatory technology (RegTech) to navigate compliance complexities efficiently. By utilizing innovative digital solutions, you can streamline your accident claims processes while ensuring adherence to local laws and regulations. Embracing these tools not only enhances your operational efficiency but also mitigates the risk of regulatory penalties.

Digital Privacy and Data Protection

Before deploying digital tools in your claims processes, it’s vital to prioritize digital privacy and data protection. Given the sensitive nature of accident information, you must ensure that your systems comply with stringent privacy laws, safeguarding your clients’ personal data against breaches and unauthorized access. This commitment not only protects your reputation but also builds trust with your clients.

Automated Compliance Monitoring

Around the landscape of regulatory technology, automated compliance monitoring has emerged as a game-changer. This technology continually scans your systems for adherence to regulations, identifying potential violations before they escalate into serious issues. By automating these processes, you enhance efficiency while alleviating the burden of manual compliance checks.

Further simplifying your compliance efforts, automated compliance monitoring offers real-time insights into your operations. As violations can have significant repercussions, utilizing these tools allows you to proactively address issues like regulatory changes or non-compliance risks. By automating this process, you save time and allocate resources more effectively, ultimately fostering a culture of adherence to laws while minimizing the potential for costly mistakes.

To wrap up

Upon reflecting on the evolving landscape of accident claims in the City of Angels, it’s clear that digital tools are profoundly transforming your experience. From streamlined communication with insurers to real-time data analysis, these innovations enhance efficiency and transparency. Embracing these tech trends not only empowers you in navigating the claims process but also ensures a more informed approach to your rights and entitlements. As you engage with these advancements, you can expect a more user-friendly and engaged claims environment, ultimately leading to better outcomes in your accident-related matters.