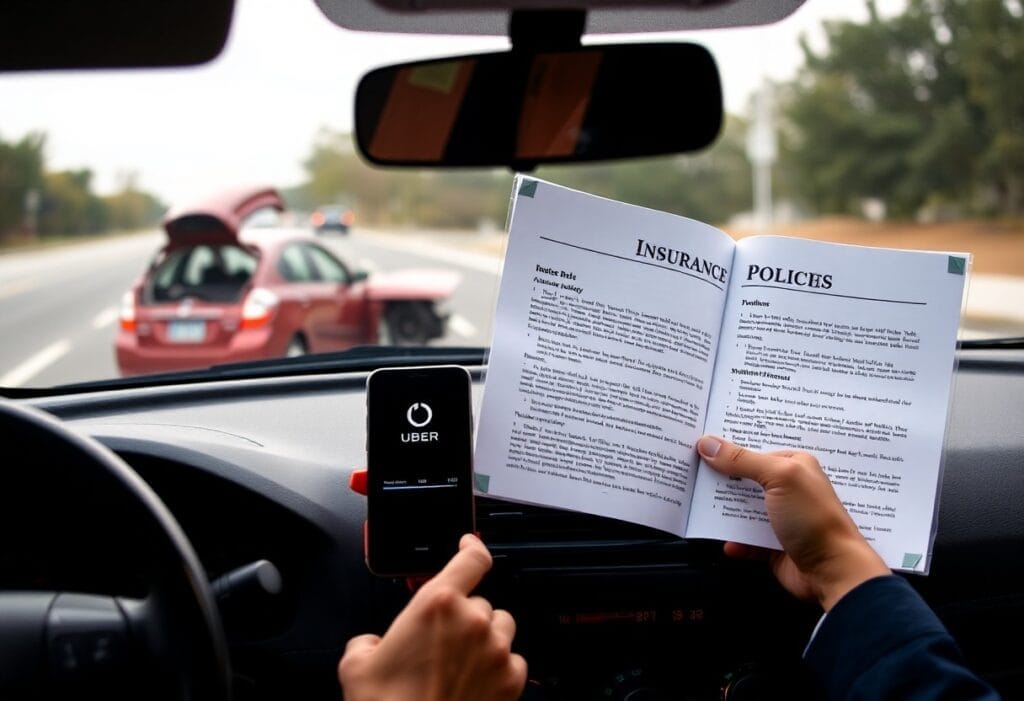

Most drivers using Uber may not fully understand the implications of the company’s insurance policies, which could leave you undercompensated following an accident. While Uber provides some coverage, these policies often come with severe limitations and exclusions that might not be clear until you’re involved in an incident. It’s crucial to be aware of the specific terms and conditions that govern your coverage, as relying solely on Uber’s insurance could compromise your financial security in the event of a serious accident.

Key Takeaways:

- Policy Gaps: Uber’s insurance may not fully cover all damages, leaving drivers or passengers financially exposed in certain situations.

- Driver Status: Compensation is heavily influenced by whether the driver is logged into the app and their current status during the incident.

- Limitations and Exclusions: Specific exclusions in Uber’s insurance policies can result in inadequate recompense for personal injuries or damage to personal property.

Understanding Uber’s Insurance Framework

The insurance framework governing Uber’s operations is a multifaceted system designed to cover drivers, riders, and third-party individuals in various scenarios. It is crucial for you as a rider or driver to grasp the nuances of this framework to protect your interests effectively. Uber implements different types of coverage tailored to several phases of a ride, which can impact your compensation in the event of an accident.

Types of Coverage Offered

With the various stages of a ride, Uber provides distinct types of coverage. Below is a breakdown of the primary insurance policies made available:

| Coverage Type | Description |

|---|---|

| Period 1 | Driver is online but hasn’t accepted a ride; maintains limited liability coverage. |

| Period 2 | Driver has accepted a ride but hasn’t picked up the rider; includes higher liability coverage. |

| Period 3 | Driver is transporting a rider; enjoys full liability coverage and potential additional benefits. |

| Third-party Coverage | Covers damages to other parties if the Uber driver is at fault. |

| Injury Coverage | Offers some protections for injuries sustained by passengers and drivers. |

Now that you know the types of coverage Uber offers, it’s equally important to consider the limitations inherent in these policies.

Limitations of Uber’s Policies

About Uber’s insurance framework, you must be aware of certain restrictions that may adversely affect your compensation after an accident. While the provided coverage options appear comprehensive, they may not be sufficient to cover all your potential medical bills or property damages. Furthermore, there are conditions that may result in reduced or denied claims, which can leave you financially vulnerable.

A significant limitation of Uber’s insurance is the maximum payout caps for certain coverage types, which may not reflect the true costs associated with injuries or losses incurred. Moreover, if you were deemed partially at fault for the accident, your compensation might be significantly reduced. You may also face challenges if you find that many insurance claims require prompt reporting, which can be difficult after the emotional and physical impact of an accident. Perceiving these limitations can be vital for making informed decisions and seeking additional coverage if necessary.

The Role of Driver and Rider Behavior

Clearly, the behavior of both drivers and riders can significantly affect the outcome of an accident and your subsequent compensation. Driver actions, such as speeding, distracted driving, or impairments can lead to a higher likelihood of an accident occurring. Meanwhile, rider behavior—including actions like distracting the driver or not wearing a seatbelt—can also play a role in the aftermath of a collision. The insurance policies in place may take these behaviors into account when determining fault and compensation, which means that even if you are a victim, you could find yourself facing reduced compensation due to factors outside your control. This complex interplay can leave you feeling vulnerable and underhydrated when it comes to financial recovery.

Factors Affecting Compensation

The impact of behaviors on compensation can be further explored through various factors that may influence your claim. These include:

- Driver negligence: If the driver was exceptionally careless, you might have a stronger case.

- Rider conduct: Participation in risky activities can contribute to liability issues.

- Environmental conditions: Weather or road conditions can sway insurance assessments.

- Previous incidents: A driver’s history may impact how your current situation is perceived.

Recognizing how these factors intersect can help you better understand the obligations of both parties and how they affect your overall compensation.

Impact of Uber’s Driver Classification

Any Uber driver is typically classified as an independent contractor rather than an employee, which is a fundamental aspect of how insurance coverage operates. This classification not only affects the type of insurance the driver is required to hold but also impacts your compensation eligibility in the event of an accident. Because the drivers are not employees, Uber’s liability may be limited in certain scenarios, which might shift some of the responsibility, and potential costs, onto your shoulders instead. You may find that drivers are often only required to carry the minimum state insurance, leaving you underprotected if an accident occurs.

Understanding this classification is necessary as it also shapes the legal landscape regarding who is responsible for damages. If the accident is deemed to be the driver’s fault, you might discover that Uber’s policies limit the available compensation that can be claimed. This means that your coverage may not cover all resulting losses, especially if the driver’s own insurance falls short of what is necessary. Furthermore, in instances where driver behavior is questioned, you could face challenges in obtaining full compensation. You must be aware of how these intricate dynamics can impact your recovery options and ensure you pursue all potential avenues for compensation post-accident.

Common Misconceptions About Coverage

“Full Coverage” Myths

Before you assume that full coverage insurance means you are completely protected in every scenario, it’s crucial to understand what this term truly entails. Many individuals mistakenly believe that having full coverage guarantees compensation for all potential damages, including those incurred while driving for Uber or during another rideshare activity. In reality, full coverage typically refers to a combination of liability, collision, and comprehensive insurance, which may not apply under Uber’s specific policies or in certain situations. Therefore, just because you hold a full coverage policy does not automatically mean you will receive the compensation you expect after an accident.

Additionally, the concept of full coverage can vary significantly between insurance providers, leading to further confusion. Different policies may have unique exclusions, limits, or terms that impact how claims are settled, particularly in situations involving rideshare driving. It’s crucial for you to thoroughly review your individual policy and consult with your insurer to confirm the extent of coverage when driving for Uber or similar services.

Understanding Deductibles and Liability

By delving into the specifics of deductibles and liability, you can gain greater insight into your potential compensation post-accident. A deductible is the amount you agree to pay out of pocket before your insurance kicks in, and this can vary significantly based on your chosen policy. For rideshare drivers, understanding how this interacts with your insurance claim is vital, as many neglect to consider that they may be on the hook for these costs initially. Furthermore, Uber operates under its own liability limits, which can impact how much you are compensated based on the specific circumstances of your accident.

A solid grasp of these elements can significantly affect the outcome of your claim. If you were driving for Uber at the time of an incident, the liability coverage offered by Uber may only come into play when rideshare responsibilities are acknowledged, and this can leave you vulnerable if other parties are also involved. Make sure to educate yourself about how deductibles apply to your situation and what your responsibilities are regarding liability, as it can help you avoid falling short in your compensation following an accident.

Navigating the Claims Process

After being involved in an accident as an Uber driver or passenger, navigating the claims process can be daunting. Many individuals are unsure of the steps they need to take in order to ensure that their claim is filed properly and that they receive appropriate compensation for any damages or injuries sustained. Knowing what to do immediately following the accident can set the tone for the entire claims process and can significantly impact the outcome of your case.

Steps to Take After an Accident

Below, you should first prioritize your safety and that of others involved. Ensure that everyone is out of harm’s way and, if needed, call emergency services for medical assistance. After the situation is stabilized, document everything you can about the accident. This includes taking photographs of the scene, injuries, and vehicle damage, as well as gathering information from witnesses and fellow drivers. You will also want to file a report with Uber, as this can be necessary in substantiating your claim later on.

Common Pitfalls in Filing Claims

Pitfalls in filing claims can lead to undercompensation and prolonged disputes with insurance companies. One of the most significant mistakes you can make is failing to gather sufficient evidence at the scene of the accident, as this documentation is often pivotal in supporting your case. Additionally, be wary of prematurely accepting a settlement offer, as these amounts can be significantly lower than what you may rightfully deserve once all damages are assessed.

In fact, many claimants overlook the importance of keeping detailed records of all communications with both Uber and the insurance companies. The lack of proper documentation can complicate your case, making it harder to prove your damages later on. Filing deadlines are another critical aspect where many people falter; if you miss these timelines, you may forfeit your right to seek compensation altogether. It is necessary to approach the claims process methodically, taking each step with care to avoid these common pitfalls.

Alternatives to Uber’s Insurance

Once again, it becomes important to explore alternatives to Uber’s insurance policies, especially when considering your safety and financial security after an accident. While Uber provides some level of coverage, there are other options that may better suit your needs. Having a comprehensive understanding of these alternatives can help you navigate the uncertainties that come with being a rideshare driver or passenger. This approach could ensure that you are adequately protected and compensated in the event of an unfortunate incident on the road.

Personal Auto Insurance Considerations

One key factor to keep in mind is that standard personal auto insurance may not cover you while driving for Uber. Many personal auto insurance policies exclude coverage during periods where you are logged into a rideshare app and waiting for a ride request. This gap can leave you vulnerable and undercompensated. Before you hit the road as a rideshare driver, you should review your policy thoroughly and speak to your insurance agent to understand your coverage and limitations fully.

Rideshare Insurance Options

The rideshare insurance market has evolved, providing flexible options tailored for drivers who frequently engage in rideshare services. This type of insurance typically fills the gaps in coverage that standard personal auto insurance policies have, ensuring that you have adequate protection while driving for rideshare companies such as Uber. Opting for rideshare insurance can not only enhance your peace of mind but also offer a broader safety net should an accident occur while you’re actively transporting passengers.

Understanding your options can significantly affect your financial recovery after an accident. In many cases, rideshare insurance policies offer similar coverage to commercial auto insurance, without the extensive costs. They can provide benefits such as liability coverage, uninsured motorist protection, and collision coverage specifically for the times when you are picking up or dropping off passengers. If you frequently drive for rideshare services, it is advisable to consider switching to or adding rideshare insurance to your existing coverage to avoid any unwanted surprises following an accident. This proactive approach can yield a safer driving experience and better financial support when you need it most.

Legal Recourse and Liability

Keep in mind that when you are involved in an accident, understanding your legal recourse is vital for proper compensation. Uber’s insurance policies may not cover all damages, leading to gaps in your financial recovery. If you find yourself facing insufficient compensation after an accident, seeking legal help should be your next priority. An experienced attorney can help you navigate the complex web of liability that often surrounds rideshare incidents. They will be able to analyze the particulars of your case and represent you against Uber, the driver, or any involved parties to ensure that you seek adequate restitution for your injuries and losses.

Seeking Legal Help

Seeking the assistance of a legal professional can significantly enhance your chances of receiving fair compensation. A personal injury attorney who specializes in rideshare accidents will understand the nuances of Uber’s insurance policies and the local laws affecting your case. By properly documenting evidence and negotiating with insurance companies on your behalf, your attorney can help you pursue what you rightfully deserve after an accident.

Understanding Your Rights

Seeking to understand your rights is vital after an accident with Uber. As a passenger or another road user, you may have specific legal protections that ensure you are compensated for your injuries, property damage, and other losses. Familiarize yourself with the rights afforded to you under local laws, especially concerning rideshare services, as these can vary significantly depending on your location.

Plus, knowing your rights empowers you to act decisively in the aftermath of an accident. If you are injured, you have the right to seek compensation for medical expenses, lost wages, and emotional distress. Additionally, if the Uber driver was at fault, you may be entitled to file a claim against Uber’s insurance policy. Being informed about your rights can help you make assertive decisions and avoid any potential pitfalls, ensuring that you do not become a victim of the inadequate coverage they provide.

Summing Up

With these considerations, it’s crucial to understand how Uber’s insurance policies may impact you in the aftermath of an accident. While the company provides coverage for drivers and riders, the limits and stipulations can lead to situations where you find yourself inadequately compensated for injuries or damages. If you assume that Uber’s insurance automatically covers all costs, you might be left with unexpected out-of-pocket expenses that strain your financial resources. This scenario is particularly true if you’re relying solely on the provided insurance instead of exploring additional personal coverage options.

Additionally, the complexity of accidents involving rideshare services often introduces varying degrees of liability and legal nuances that can affect compensation. If you do not fully comprehend your rights and the specific terms of Uber’s insurance policy, you may struggle when seeking the compensation you deserve. Engaging with a legal expert in rideshare accidents can empower you to navigate these intricacies effectively, ensuring that you secure the best possible outcome while protecting your interests. Ultimately, thorough research and proactive measures are key to safeguarding your financial well-being after an accident involving such services.